November 12, 2021

Les brèves de l'actualité | 12 novembre 2021

Les brèves de l'actualités vous sont partagés par le Programme Accélérateur 360 - cliquer sur le document pour y avoir accès https://www.aeromontreal.ca/accelerateur360.html

April 15, 2020 | Local, Clean technologies, Big data and Artifical Intelligence, Advanced manufacturing 4.0, Autonomous systems (Drones / E-VTOL), Virtual design and testing, Additive manufacturing

SENIOR PARTNER, CO-HEAD OF GLOBAL AEROSPACE & DEFENCE PRACTICE

Hamburg Office, Central Europe

The COVID-19 pandemic has the potential to trigger a global economic crisis of significant dimensions, affecting all industries. One of the industry sectors in the eye of the coronavirus storm is aerospace. Global air traffic has been brought to an almost complete standstill by the COVID-19 outbreak. While air traffic has consistently shown a solid recovery from previous crises, the debate is wide open about how traffic will recover following the current crisis and what this will mean for the civil aircraft manufacturing industry, the supply chain and aftermarket support businesses.

Previous crises like 9/11, SARS or the financial crisis of 2008/09 all demonstrated a recovery along V- or U-shaped curves back to the pre-crisis growth path. As COVID-19 is a fully global crisis of unprecedented magnitude, we need to consider whether we might see an L-shaped recovery with consistently lower levels of air traffic and permanently slower growth after the crisis.

The debate is fueled by two questions for which there is no real precedent to extrapolate from but which could be transformational for the industry:

This article discusses three key questions:

The magnitude of the air traffic crisis can be characterized by four key indicators:

The longer the restrictions last, the more airlines will run out of liquidity, leading to bankruptcies, nationalizations or consolidation, hence causing an irreparable change in the industry landscape and customer structure for aircraft manufacturers. Moreover, the longer the restrictions last, the greater the possibility that temporary behavioral changes imposed by the pandemic may become permanent (e.g. reduction of business travel as a result of increased digital communication).

Once the air travel restrictions are lifted, the time to recovery will be impacted by potential new outbreaks of the disease, leading to recurrent waves of further travel restrictions and hence fluctuating travel volume at lower levels.

The combination of a long duration of travel restrictions and repeated outbreaks over an extended period of time might lead to a "new normal", with global air traffic volumes settling at a lower level – an effect that has never occurred before in the history of commercial aviation.

The combination of a long duration of travel restrictions and repeated outbreaks over an extended period of time might lead to a "new normal", with global air traffic volumes settling at a lower level – an effect that has never occurred before in the history of commercial aviation.

It can already be anticipated that the post-crisis aerospace industry will not look like it did before the crisis:

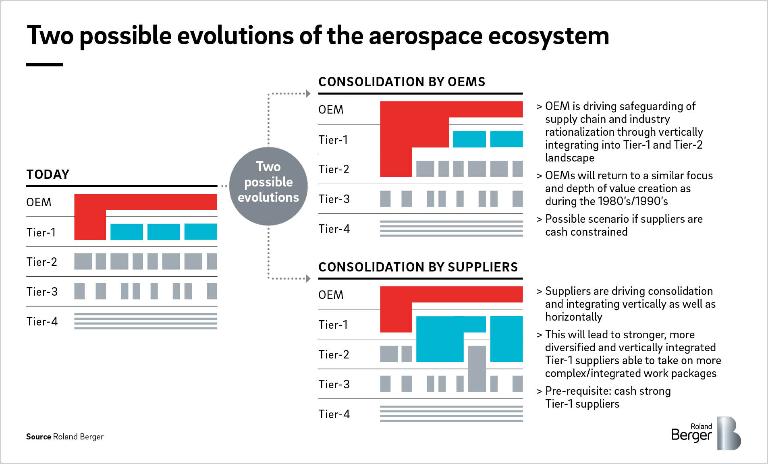

One of two possible post-crisis industry models could emerge:

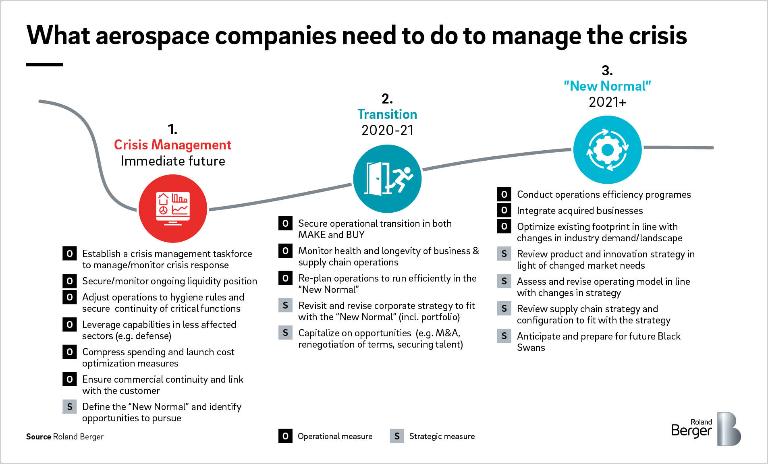

As the aerospace industry relies on a highly interconnected and mutually dependent supply chain, the crisis needs to be managed on two levels in parallel:

On an individual company level, cash will be king. Protecting cash positions will be key to ensuring survival while managing the ramp-down, stabilizing and securing the supply chain and seizing opportunities in the market – we may therefore expect a cash squeeze in May and June as new production schedules become established but activities have not yet been rationalized. Preparing for the "new normal", rightsized and potentially repositioned operations must start immediately. To this end, the company's strategy, its industrial footprint and operating model, needs to be reviewed and a blueprint developed to fit with the "new normal" and provide the right framework for short-term actions and strategic moves.

At industry level, companies and governments will need to work closely together to ensure that key industrial capabilities do not fall through the cracks, as this would put the whole industry at risk. Therefore, the industry will have to:

Once this picture is clear, government support may need to be called upon to safeguard the short-term functioning of the industry and help manage the transition to the "new normal" for this strategically important sector.

November 12, 2021

Les brèves de l'actualités vous sont partagés par le Programme Accélérateur 360 - cliquer sur le document pour y avoir accès https://www.aeromontreal.ca/accelerateur360.html

May 7, 2021

FAITS SAILLANTS INNOVATION ET TIC Budget du Canada 2021-2022 Prompt souligne les investissements faits par le Gouvernement du Canada en ce qui a trait à l'intelligence artificielle, les technologies quantiques, la cybersécurité et les technologies numérique dans leur ensemble. L'innovation sous toutes ses formes est inhérente au budget déposé par le gouvernement fédéral. Cet article cite les faits saillants relatifs aux technologies de l'information et de la communication du Budget 2021-2022 du Gouvernement du Canada. - L'équipe de Prompt Stratégie pancanadienne en Intelligence Artificielle 443,8 M$ sur 10 ans Stratégie quantique nationale 360 M$ sur 10 ans Amplifier les forces importantes du Canada dans la recherche quantique. Élargir les technologies, les entreprises et les talents prêts à évoluer dans l'univers quantique. Renforcer le leadership mondial du Canada dans ce domaine. Création d'un secrétariat au ministère de l'Innovation, des Sciences et du Développement économique Ré-outiller et de moderniser le Centre canadien de fabrication de dispositifs photoniques. Permettre au centre de continuer d'aider les chercheurs canadiens, d'accompagner les entreprises du pays dans leur croissance et de soutenir des emplois très qualifiés. Améliorer la collecte de données sur les menaces à la cybersécurité 4,1 M$ sur 5 ans Poursuite du programme d'enquête sur la cybersécurité et la cybercriminalité. ++ ANNONCE DU 6 MAI 2021 ++ Le gouvernement du Canada investit pour que le Canada devienne un chef de file mondial de la cybersécurité Lancement du Réseau d'innovation pour la cybersécurité 80 M$ sur 4 ans Financement de « la création d'un réseau national composé de plusieurs centres d'expertise en cybersécurité affiliés à des établissements d'enseignement postsecondaire de partout au Canada, en collaboration avec le secteur privé, le secteur sans but lucratif, des gouvernements provinciaux ou territoriaux, des administrations municipales et d'autres établissements d'enseignement postsecondaire canadiens. Le réseau travaillera avec ces partenaires pour intensifier la recherche et le développement, accroître la commercialisation et former des personnes de talent spécialisées en cybersécurité aux quatre coins du pays.» Sources: Cision et Innovation, Sciences et Développement économique Canada Redynamiser le Centre canadien de fabrication de dispositifs photoniques 90 M$ sur 5 ans Appuyer l'initiative des supergrappes d'innovation 60M$ sur 2 ans Investissement en éducation Enseigner aux enfants à coder 80 M$ sur 3 ans Aider le programme CodeCan à rejoindre 3 millions d'élèves de plus (accent sur les groupe sous-représentés) ; 120 000 enseignants de plus Soutien aux entreprises et jeunes travailleurs par Mitacs 708 M$ sur 5 ans Création d'au moins 85 000 stages d'apprentissage intégré au travail ; Soutien aux entreprises pour développer des talents et prendre de l'expansion.

November 6, 2020

Si vous avez de la difficulté à lire ce courriel, consultez la version en ligne. VOLUME 21, No 42 5 novembre 2020 Événements à venir Occasions d'affaires Actualités Tour de force pour la première édition virtuelle de la Journée Donneurs d'ordres/Fournisseurs La gestion de projets : Source de profits pour les PME Joignez-vous au prochain webinaire STIQ, présenté par Triode, le 12 novembre prochain à 12 h G.M. Précision : une entreprise en pleine expansion Découvrez la vidéo de présentation de G.M. Précision Une fonderie «verte» à Montréal-Nord : l'entreprise Vestshell Une entreprise de Montréal-Nord, qui s'est réinventée pour réduire son empreinte écologique, est devenue un modèle international en matière de développement durable dans son domaine ABB et Lion Électrique font équipe pour appuyer la mobilité électrique en Amérique du Nord Les deux entreprises ont fait équipe pour vendre de l'équipement de recharge de véhicules électriques (VÉ) et en faire l'entretien. Cette union favorisera l'essor de la mobilité électrique en Amérique du Nord Bienvenue aux nouveaux membres! STIQ est fière d'annoncer la récente adhésion de Lux Aeterna, MP Repro et Signalisation Ver-Mac à son réseau multisectoriel d'entreprises manufacturières Forum d'affaires Canada-Italie sur l'intelligence artificielle Joignez-vous à un forum virtuel d'envergure internationale sur l'intelligence artificielle du 18 au 20 novembre prochain, organisé par la Chambre de Commerce italienne au Canada Industrie 4.0 – La transformation des entreprises à l'ère de la quatrième révolution industrielle Participez à la 3e édition de cette formation, du 30 novembre au 9 décembre prochain, offerte en collaboration avec le Consortium de recherche en ingénierie des systèmes industriels 4.0 Session de coaching innovation en ligne Expansion PME offre des services d'accompagnement aux PME afin de les orienter et les outiller dans leurs démarches en exportation et en innovation Découvrez le programme de Creaform Connect ! Moitié salon et moitié conférence, cet événement virtuel gratuit est un incontournable pour les professionnels qui cherchent à relever leurs défis en développement et fabrication de produits! L'avenir d'une industrie minière post-Covid Découvrez cet article de Michel Corbin, président-directeur général, NeoSynergix Les bonnes nouvelles de l'industrie Bombardier Transport, AddÉnergie, Chantier Davie Canada, Rio Tinto, Nova Bus, Groupe Stelpro, Nouveau Monde Graphite, Hydro-Québec, Dana, Groupe Stelpro, Flextherm, Société de transports de Sherbrooke (STS) Occasions d'affaires Occasions d'affaires privées 2020CA017 – Recherche de fournisseur d'assemblage par la mesure laser Aérospatiale (manufacturier, entretien et services) 2020SC045 – Recherche une presse plieuse de 16 pouces / 220-260 tonnes. Produits métalliques Occasions d'affaires Appels d'offres publics 2020NR374 – Convoyeur mobile Machinerie 2020NR373 – Blocs et plaques de blindage en acier, pour application UCN d'accélération de particules Énergie (production et distribution) 2020NR372 – Camion fourgon aménagé pour service d'aqueduc Transport (fabrication de matériel de), sauf aérospatiale 2020NR371 – Camion fourgon atelier, pour service de travaux publics Transport (fabrication de matériel de), sauf aérospatiale 2020NR370 – Fourniture de contenants duo poubelle/recyclage pour parcs Environnement 2020NR369 – Entretien préventif, correctif ou d'urgence d'appareils de levage Machinerie 2020NR359 – Fourniture et installation de panneau électrique, pour sous-station d'usine de filtration Environnement 2020NR358 – Aménagement d'1 fourgonnette avec monte-charge et d'1 mini-fourgonnette Transport (fabrication de matériel de), sauf aérospatiale 2020NR357 – Entretien préventif, correctif ou d'urgence d'appareils de levage Énergie (production et distribution) 2020NR356 – Entretien correctif et préventif de vérins hydrauliques Énergie (production et distribution) Devenez membre Obtenez des avantages exclusifs Membres de STIQ Publiez Consultez les archives