April 16, 2021

Agility Prime Researches Electronic Parachute Powered by Machine Learning - Aviation Today

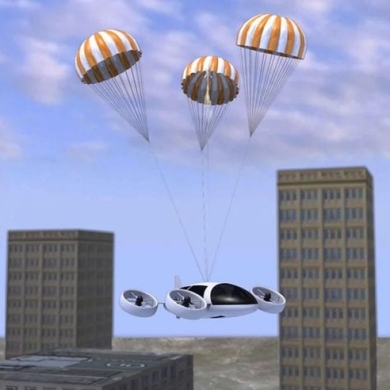

The Air Force’s Agility Prime program awarded a phase I small business technology transfer (STTR) research contract to Jump Aero and Caltech.

January 21, 2020 | International, Additive manufacturing

What's going on in that printing machine?

For surgical repairs to a patient's hip or skull, surgeons might use a titanium bone implant. However, metal objects such as these – with complex outer forms, or with intricate internal features such as ducts or channels – can be difficult to make using conventional processes. To create these useful devices, manufacturers are turning to 3D printing, a process that typically involves building a part layer by layer, sometimes over minutes or hours.

3D printing of metal objects is a booming industry, with the market for products and services worth more than an estimated $2.3 billion in 2015 – a nearly five-fold growth since 2010. It's increasingly popular in the medical, aerospace, and automotive industries, where it can be used to make complex components such as fuel injector nozzles for engines.

But the commercial technology is still relatively new, and maintaining quality control can be challenging and time-consuming. Two supposedly identical products made in the same way on the same machine don't necessarily come out with the same dimensions. Tiny imperfections can appear in the layers, reducing the strength properties of the components. And residual stresses can build up as the layers cool, creating cracks between layers and warping the parts. The stress can be so high, in fact, that it can warp a 1-inch thick piece of steel by a millimeter.

To give manufacturers more control over this process, NIST researchers have built a metal 3D printing testbed, a custom-made printer that they can use to produce tools that will allow users to monitor the process in real time.

The researchers hope to answer some fundamental questions, such as: How hot does the melting metal get in each layer? How do you lower the stresses that cause cracking and warping? And what sensors would you need in order to provide better information about what's happening inside the printing machine?

Eventually, the researchers hope their system will be useful beyond 3D printing of metal objects, to look at solid materials that experience extreme heat, such as the wingtips of supersonic aircraft.

https://www.nist.gov/pml/about-pml/pml-working-you/better-control-over-3d-printing

April 16, 2021

The Air Force’s Agility Prime program awarded a phase I small business technology transfer (STTR) research contract to Jump Aero and Caltech.

March 8, 2021

As the Air Force pieces together its fiscal 2023 budget, due early next year, it must think about a murky future five years down the road.

April 2, 2020

Aaron Mehta A congressionally mandated panel of technology experts has issued its first set of recommendations for the government, including doubling the amount of money spent on artificial intelligence outside the defense department and elevating a key Pentagon office to report directly to the Secretary of Defense. Created by the National Defense Authorization Act in 2018, the National Security Commission on Artificial Intelligence is tasked with reviewing “advances in artificial intelligence, related machine learning developments, and associated technologies,” for the express purpose of addressing “the national and economic security needs of the United States, including economic risk, and any other associated issues.” The commission issued an initial report in November, at the time pledging to slowly roll out its actual policy recommendations over the course of the next year. Today's report represents the first of those conclusions — 43 of them in fact, tied to legislative language that can easily be inserted by Congress during the fiscal year 2021 budget process. Bob Work, the former deputy secretary of defense who is the vice-chairman of the commission, said the report is tied into a broader effort to move DoD away from a focus on large platforms. “What you're seeing is a transformation to a digital enterprise, where everyone is intent on making the DoD more like a software company. Because in the future, algorithmic warfare, relying on AI and AI enabled autonomy, is the thing that will provide us with the greatest military competitive advantage,” he said during a Wednesday call with reporters. Among the key recommendations: The government should “immediately double non-defense AI R&D funding” to $2 billion for FY21, a quick cash infusion which should work to strengthen academic center and national labs working on AI issues. The funding should “increase agency topline levels, not repurpose funds from within existing agency budgets, and be used by agencies to fund new research and initiatives, not to support re-labeled existing efforts.” Work noted that he recommends this R&D to double again in FY22. The commission leaves open the possibility of recommendations for increasing DoD's AI investments as well, but said it wants to study the issue more before making such a request. In FY21, the department requested roughly $800 million in AI developmental funding and another $1.7 billion in AI enabled autonomy, which Work said is the right ratio going forward. “We're really focused on non-defense R&D in this first quarter, because that's where we felt we were falling further behind,” he said. “We expect DoD AI R&D spending also to increase” going forward. The Director of the Joint Artificial Intelligence Center (JAIC) should report directly to the Secretary of Defense, and should continue to be led by a three-star officer or someone with “significant operational experience.” The first head of the JAIC, Lt. Gen. Jack Shanahan, is retiring this summer; currently the JAIC falls under the office of the Chief Information Officer, who in turn reporters to the secretary. Work said the commission views the move as necessary in order to make sure leadership in the department is “driving" investment in AI, given all the competing budgetary requirements. The DoD and the Office of the Director of National Intelligence (ODNI) should establish a steering committee on emerging technology, tri-chaired by the Deputy Secretary of Defense, the Vice Chairman of the Joint Chiefs of Staff, and the Principal Deputy Director of ODNI, in order to “drive action on emerging technologies that otherwise may not be prioritized” across the national security sphere. Government microelectronics programs related to AI should be expanded in order to “develop novel and resilient sources for producing, integrating, assembling, and testing AI-enabling microelectronics.” In addition, the commission calls for articulating a “national for microelectronics and associated infrastructure.” Funding for DARPA's microelectronics program should be increased to $500 million. The commission also recommends the establishment of a $20 million pilot microelectronics program to be run by the Intelligence Advanced Research Projects Activity (IARPA), focused on AI hardware. The establishment of a new office, tentatively called the National Security Point of Contact for AI, and encourage allied government to do the same in order to strengthen coordination at an international level. The first goal for that office would be to develop an assessment of allied AI research and applications, starting with the Five Eyes nations and then expanding to NATO. One issue identified early by the commission is the question of ethical AI. The commission recommends mandatory training on the limits of artificial intelligence in the AI workforce, which should include discussions around ethical issues. The group also calls for the Secretary of Homeland Security and the director of the Federal Bureau of Investigation to “share their ethical and responsible AI training programs with state, local, tribal, and territorial law enforcement officials,” and track which jurisdictions take advantage of those programs over a five year period. Missing from the report: any mention of the Pentagon's Directive 3000.09, a 2012 order laying out the rules about how AI can be used on the battlefield. Last year C4ISRNet revealed that there was an ongoing debate among AI leaders, including Work, on whether that directive was still relevant. While not reflected in the recommendations, Eric Schmidt, the former Google executive who chairs the commission, noted that his team is starting to look at how AI can help with the ongoing COVID-19 coronavirus outbreak, saying "“We're in an extraordinary time... we're all looking forward to working hard to help anyway that we can.” The full report can be read here. https://www.c4isrnet.com/artificial-intelligence/2020/04/01/panel-wants-to-double-federal-spending-on-ai/