November 27, 2020

Blast, un programme soutenu par Starburst qui veut faire exploser les startups françaises du spatial

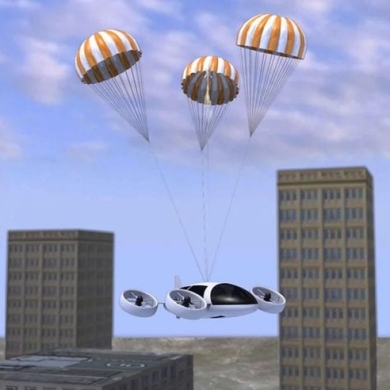

Plusieurs spécialistes de l'innovation se sont alliés pour créer Blast, le premier programme français d'accélération de jeunes pousses à fort contenu technologique dans les domaines de l'aéronautique, du spatial et de la défense afin de « faire émerger et d'accompagner une vingtaine de start-up par an ». Le programme réunit Starburst, premier accélérateur mondial dédié aux start-up de l'aéronautique, du spatial et de la défense (ASD), l'Office national d'études et de recherches aérospatiales (Onera), l'École Polytechnique et la SATT Paris-Saclay, dont le but est de développer la mise en oeuvre des innovations issues de la recherche académique. À l'origine du projet, qui sera formellement lancé en janvier, le constat du « manque d'un programme constitué en France dédié à l'accompagnement des projets deep tech (portant sur des technologies très avancées, NDLR) pour le secteur » de l'aéronautique, de la défense et du spatial, expliquent ses promoteurs dans un communiqué. Si les jeunes pousses dans ces domaines sont particulièrement actives aux États-Unis ou encore en Israël, le mouvement doit être « être renforcé en Europe et particulièrement en France », estiment-ils. D'autant que l'aéronautique, le spatial et la défense « portent par nature les caractéristiques du deep tech: de fortes barrières à l'entrée, un cycle de développement long et complexe et un caractère disruptif fort en cas de succès ». Des levées de fonds d'amorçage prévues Le programme doit permettre d'accompagner des projets correspondant aux besoins de l'industrie et de les pérenniser par des contrats commerciaux et des collaborations avec les industriels ou instituts publics. « L'idée, c'est de créer plus de start-up pour alimenter les futurs programmes aéronautiques, spatiaux et de défense », résume François Chopard, fondateur de Starburst, qui assurera la coordination du programme. Les domaines visés sont notamment ceux de l'aviation décarbonée, les plateformes de mobilité aérienne urbaines, l'intelligence artificielle, les technologies portant sur l'autonomie (capteurs, fusion de données), les services informatiques dématérialisés (cloud) sécurisés ou encore le spatial. Des levées de fonds « d'amorçage de deux à trois millions d'euros » sont prévues. Blast est l'un des dix programmes sélectionnés par le gouvernement à l'issue d'un appel à projets d'accompagnement de start-up à fort contenu technologique dans le cadre du Programme d'investissements d'avenir (PIA) Doté d'un montant maximal global de 9,6 millions d'euros, le soutien public, via Bpifrance, permettra des subventions allant jusqu'à 50% du coût du projet pendant les deux premières années. https://www.frenchweb.fr/blast-un-programme-soutenu-par-starburst-qui-veut-faire-exploser-les-startups-francaises-du-spatial/410612